School of Commerce and Professional Studies

FAQ

ACCA (UK), CPA (US) and CA are courses mainly focussing on financial accounting. Whereas CMA (Ind) and CMA (US) are courses focussing on management accounting. CIMA’s CGMA is a charted qualification that gives equal weightage to accounting, as well as managerial skills.

If you prefer to work in the UK, you should prefer the ACCA or the CIMA. If you are planning to work in the US, it would be better to do either the CPA (US) or CMA (US). If you prefer to work in India, you should prefer the CA or the CMA (Ind). CA and CMA (IND) are professional qualifications provided by Indian Statutory Institutions. ACCA and CIMA (CGMA FLP) are globally recognized chartered professional qualifications equivalent to a UK university Master’s degree.

CMA (US) is the highest level of certification in management accounting awarded by the Institute of Management Accountants (IMA), USA.

CA and CMA (IND) take longer duration and usually require 3 – 4 years to complete. ACCA can be completed within 3 to 4 years and for B Com students, it can be completed within 1 year of course completion. CGMA FLP usually takes 2-3 years and can be completed along with B Com itself. CMA (US) usually takes 1-2 years but BCom students who are studying in IMA-approved institutions like Marian can complete it along with B Com itself.

B Com with ACCA

Study ACCA in Kerala with Marian College Kuttikkanam Autonomous

The Association of Chartered Certified Accountants (ACCA, UK) is a global professional accounting body offering Chartered Certified Accountant qualification. ACCA, UK is a fast-growing international accountancy organization. ACCA qualification is a globally recognized accountancy qualification for finance professionals. ACCA provides a broad and strong foundation for students in professional accounting, tax consulting, auditing, and business valuations which is at par with industry requirements. The ACCA qualification opens up opportunities for students to work in different industries and in various leadership roles across the world. ACCA has flexibility in terms of examinations and there is no articleship training, which allows students to qualify for the examinations at their convenience. Students can pursue ACCA along with their graduation or post-graduation.

Please visit www.accaglobal.com for more information. The first level of the ACCA programme is the Knowledge Level [4 papers], which is exempted for the students who have completed their B Com/M Com Programme. The second level of the ACCA programme is the Skill Level [5 papers] which is compulsory for students to advance to the Professional Level. Marian College Kuttikkanam Autonomous is the top college in Kerala that provides training or orientation for ACCA qualification with 6 paper exemptions (4 Knowledge Level and 2 Skill Level Papers) along with B Com Programme. Marian College Kuttikkanam Autonomous is the best college in Kerala that provides the best training for ACCA with excellent results. Marian College is one of the few accredited colleges by ACCA (UK) in Kerala.

The syllabus of the B Com Programme is integrated with the syllabus of ACCA.

The School of Commerce and Professional Studies of Marian College is considered the best commerce department for commerce courses in India as it offers a wide variety of programmes with a lot of freedom and flexibility in its curriculum with good placements. The Commerce Department offers much sought after electives such as Finance and Taxation, cooperation, and Business Analytics. Students who are really interested in Professional Qualifications are immensely benefited from the additional training programmes imparted by the commerce department for professional qualifications such as CA, CMA (Ind), ACCA(UK) and CMA(US), CGMA FLP (UK) and CPA (US) along with their regular B Com/ M Com programme.

Students have the opportunity to complete their ACCA Qualification at Marian. The ACCA program at Marian College is taught by expert world-class faculty members.

With consistent good results, Marian is the best college for ACCA in India.

Students progress through three elements of the ACCA Qualification on their journey to ACCA membership, these are:

- ACCA exams

- an Ethics and Professional Skills module and

- a Practical Experience Requirement

ACCA exams have 13 papers, which are divided into 3 levels.

- Knowledge Level – 6 Papers

- Skill Level: 3 Papers

- Professional Level: 4 (2 essentials and 2 options)

Further details are available at https://www.accaglobal.com/lk/en/student/getting-started/acca-qualification-structure.html

Students can pursue the course along with their graduation. The minimum ACCA course duration is 3 years. It has a flexible examination scheme which makes this qualification more attractive. At Marian, students can complete their 9 Papers along with B Com Programme (6 papers exempted and 3 written). After completing the B Com with 9 ACCA papers in 3 years, they can complete the remaining 4 professional papers in a year.

Four exam cycles every year (March, June, September, and December)

Students can opt for a computer-based exam (CBE) or a paper-based exam

The ACCA papers are of 100 marks each with the questions both MCQ as well as descriptive. The first and second sections called ‘Section A’ and Section B carries MCQ, and the third section called ‘Section C’ carries descriptive questions, usually case studies.

ACCA exams are held quarterly and take place at ACCA-approved exam centers spread all over the country.

Yes. Marian College provides ACCA students with opportunities for placements in leading auditing and accounting firms like EY, PWC, KPMG, Deloitte, Grant Thornton, Accenture, IBM, and many Indian companies like TATA Group, and Hindustan Unilever.

- Financial Accountant

- Management Consultant

- Auditor

- Tax Consultant

- Forensic Auditor

- Compliance/ Governance Sector

- Business Analyst

- Risk Manager

- Funds Manager

- Financial Analyst

- Marian College Kuttikkanam Autonomous is an ACCA-accredited institution.

- Marian’s B Com syllabus is approved by ACCA

- Marian provides an opportunity for students to study ACCA along with B Com and qualify for the first two levels of ACCA – Knowledge Level and Skill Level.

- 6 papers out of the 9 papers in Knowledge Level and Skill Level are exempted. The remaining 3 papers need to be completed along with B Com. SCAPS Department Marian college is arranging classes to prepare students to write one paper each year, thereby helping students to manage both B Com and ACCA exams comfortably.

- Marian provides highly efficient and excellent external faculty members to tutor the students. Students who wish to secure B Sc in Applied Accounting from Oxford Brookes University, England must complete one project and one ethics module after completing Knowledge Level and Skill Level papers.

Qualified Chartered Accountants from ICAI are authorized to sign Audit Reports and Financial Statements in India. An ACCA member is not legally authorized to sign the audit report and Financial Statements in India. However, the wider reach globally and presence of MNCs in India create a lot of national and global career opportunities.

After completing B Com in Marian along with 9 papers of ACCA, students can complete the Professional Level of ACCA within 1 year.

All 9 papers in the Knowledge Level and Skill Level are integrated into the Syllabus of the BCom programme and out of that, 6 papers are exempted by ACCA. For the remaining 3 papers additional training will be provided during the three years. Since the curriculum is already integrated into the B Com syllabus, which allows students to focus on one standardized study approach, the students will be able to write their B Com exams along with the ACCA papers.

Though it is not required as per ACCA accreditation, opportunities for Practical Training/Internship for 2 months with an ACCA employer will be arranged in association with ACCA, UK and our knowledge and learning providers.

ACCA conducts Computer Based Exams (CBE) in March, June, September, and December every year at the Centers authorized by ACCA. ACCA exams are for 100 marks and the duration of the Exam is 3 hours. Students are required to obtain a minimum of 50% marks to pass each ACCA paper. Kochi and Thiruvananthapuram are the ACCA test centers approved in Kerala.

Special classes are conducted after regular class hours for all professional courses. Also, residential students will be given study time each day from 2:30 pm -8:00 pm under the guidance of a coordinator. Classes will be handled by external ACCA-qualified and experienced faculty.

Considering the views of industry experts, Marian has decided to opt for a 6-paper exemption, instead of a 9-paper exemption. Too many exemptions may lead to the underrating of students by the industry, with the expected knowledge level getting diluted. Also, the option to do B Sc in Applied Accounting is unavailable to students who are pursuing ACCA with more than six paper exemptions.

| Audit & Accounting Companies | Banking Companies |

| 8L – 10L per annum | 7L – 8L per annum |

Study CGMA FLP, powered by CIMA and AICPA, in Kerala with Marian College Kuttikkanam Autonomous

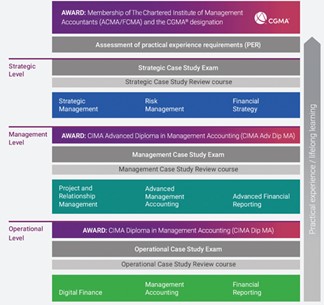

CIMA (Chartered Institute of Management Accountants) is a globally recognized qualification for careers in Business & Finance. CIMA is the world’s largest professional body of Management Accountants with more than 250,000 members working in around 180 countries.

CIMA, the trendsetter for professional education for Management Accountants for over a century, has introduced a new revolutionary learning and assessment platform, developed by working professionals – The CGMA Finance Leadership Program (CGMA – FLP). The CGMA-FLP teaches the skills that 2,000 finance teams have identified as being critical for your career.

The Chartered Global Management Accountant (CGMA®) designation is the most widely held management accounting designation in the world. Through a CGMA designation, you will gain access to a global professional network and lifelong career support through the Association of International Certified Professional Accountants®, the world’s leading and largest professional body for accountants, which underpins CIMA and the American Institute of CPAs® (AICPA® ).

CGMA boldly announces your commercial skills, strategic vision, and transformational mindset. It showcases your global value by demonstrating your leadership, people, digital and financial skills. CGMA-qualified professionals are in high demand across various industrial sectors in India and abroad and they

work in various fields like corporate finance, financial reporting, financial analysis, business analysis, project finance, treasury management, risk management etc.

Marian College provides CGMA aspirants with world-class quality training from CIMA-qualified and experienced industry experts. This comprehensive professional training offered by the Commerce Department of Marian College Kuttikkanam (Autonomous) aims at guiding the students to be future-ready and helps them in their career progression.

If you want to be CGMA qualified, don’t worry, because CIMA has now provided multiple flexible eligibility criteria. The eligibility criteria suit every student according to the given terms.

- Matriculation or O-level

- Intermediate or A-Level

- Undergraduate or Graduate in any degree

- MBA Degree for fast eligibility to enter CIMA course

- Or any other professional qualification and hence enrolling you at a strategic level of CIMA.

A dedicated CGMA aspirant who enrolls in Marian for B Com can complete all three CGMA levels in three years, with exclusive member benefits available only to Marian.

CIMA Course concepts focus on>

For Certification Level

- BA1- Fundamentals of Business Economics

- BA2- Fundamentals of Management Accounting

- BA3- Fundamentals of Ethics, Business Law, and Corporate Governance.

- BA4- Fundamentals of Financial Accounting

- E1- Organizational Management

- P1- Management Accounting

- F1- Financial Reporting and Taxation

- E2- Project And Relationship Management

- P2- Advanced Management Accounting

- F2- Advanced Financial Reporting

- E3- Strategic Management

- P3- Risk Management

- F3- Financial Strategy

For Operational Level

For Managerial Level

For Strategic Level

The candidates appearing for all 16 papers can complete the CIMA course nearly in 2.5 years. Moreover, it is recommendable that students should take up one paper at a time. It will utilize 365 days to appear for all the papers.

The CGMA FLP is designed to assess your progress and performance as you learn each topic. The only exams you’ll take are the case study exams to complete each of the three levels of learning: Operational, Management, and Strategic.

The case study exam can be described as a “role simulation” because it reflects what happens in the real world by providing scenarios that reflect various types of organisations and industries and require candidates to take on the kind of role a CGMA member would have in the simulated organisation.

Case study exams are available in four testing windows throughout the year and assessed by a human marker. The time limit for a case study exam is 3 hours and the exam can be taken in any test centre in Kerala.

You can take the CGMA case study exams in February, May, August, and November. Within each exam window, you’ll be able to sit for five days – from Tuesday to Saturday.

CIMA’s CGMA FLP exams can be sat at over 5,000 Pearson VUE test centers in 178 countries

CGMA FLP classes at Marian are taken and led by a CIMA qualified professional who is also the only approved CGMA academic champion in Kerala. Having extensive industry experience, our professionals are truly qualified to tutor and mentor students with the correct knowledge and skill set to succeed.

Marian college kuttikkanam motivates students to apply topics learned in class and prepare for career realities. We provide hands-on and experience learning, as well as soft skills training and job placement support.

Job Opportunities for CIMA (UK)

The aspirants who have a CIMA qualification are considered experts in financial accounting, management, accounting, and various other fields. The candidates have a diverse range of options to choose for their career, and they can opt for any of the following mentioned job profiles:

- Management consultant

- Business analyst

- Management accountant

- Financial controller

- Forensic Accountant

- Project manager

How is the fees structure of CIMA (UK)? – to be updated

There are a total of 12 exams conducted under the CIMA course. For each exam, students have to face the cost of one lakh. These 12 exams are conducted at four different levels. For each level, it will cost you around one lakh. Thus the tuition cost for four different levels in CIMA is around four lakhs. However, you have a flexible option to work along with the course of CIMA.

What is the salary for CIMA in the UK? – to be updated

The candidates with CIMA qualifications can get a job in different industries like banking and IT sectors. Generally, the starting salary of the CIMA qualified candidate varies according to the location, size of the firm, and due to other factors. The candidates can expect an average salary of £25,000 to £40,000 in the starting. With the increasing time, candidates’ salary increases depending on the experience and knowledge gained by the candidates.

The scaled scores of each CIMA exam is in the range of 0-150. To pass the exam, a mark of 100 or above is required.

Case study exams

Exam pass rate: total exams passed / total exams taken.

B Com with CMA US

Study CMA US in Kerala with Marian College, Kuttikkanam

The Certified Management Accountant (CMA,US) course offered by IMA (Institute of Management Accountants) of USA is a highest level professional certification in management accounting and financial management fields. The CMA (US) Course is globally recognized and appropriate for accountants and financial professionals in the business. CMA US course is recognised in India as well. This globally accepted course equips the students to upskill the competencies of management accounting, such as planning and analysis, technology and analytics, risk management and internal controls and performance management. CMA US offers a wide range of career options. Students can complete the CMA US course within 12 to 18 months.

Marian college has signed a MOU with IMA USA in the month of April 2021. Marian College is gaining popularity for the CMA US course. The Commerce department of Marian college supports those students who want to make it big in their global career in the field of Management Accounting.

- The students need to have a bachelor’s degree from any accredited college/university or a related professional certification.

- The students need to have an active membership in IMA (Institute of Management Accountants)

- The students should have continuous years of professional experience in management accounting or financial management, which can be completed after passing the exam, but are required as a final step to certification.

CMA US course has two part examinations where the exams are graded for 500 points and an aspirant is required to score a minimum of 360 to qualify the exams. Both parts follow the same pattern.

Depending on the aspirant’s plan and study schedule US CMA certificate can be completed in a minimum of 6 months to 3 years. As per the guidelines of IMA, an aspirant is required to complete the exams within 3 years from the date of registration

The CMA exam is available during the following schedule:

- January and February

- May and June

- September and October

Candidates are required to apply before the due date for the exam sessions. Marian College will provide the necessary support in the application processes to ensure its smooth flow.

With three testing windows every year you can sit for the exam at any time or place that is feasible for you. The CMA exam is basically a computer-based exam and is administered at hundreds of prometric testing centers all over the world.

- Testing windows are offered in January/February, May/June, and September/October. You have to pick your window. Thiruvananthapuram is one of the centers available in Kerala.

- You then have to register for the exam on the IMA website : www.imanet.org

- You will receive your Authorization number along with further instructions.

CMA (US) has two parts. Part 1 of the US CMA certification mainly covers Financial Planning, Performance, and Analytics and Part 2 of the US CMA certification mainly covers Strategic Financial Management.

The topics covered in CMA Part 1 are given below:

· External Financial Reporting Decisions 15%

· Planning, Budgeting, and Forecasting 20%

· Performance Management 20%

· Cost Management 15%

· Internal Controls 15%

· Technology and Analytics 15%

The topics covered in CMA Part 2 are given below:

· Financial Statement Analysis – 20%

· Corporate Finance – 20%

· Decision Analysis – 25%

· Risk Management – 10%

· Investment Decision – 10%

· Professional Ethics – 15%

Each CMA exam part consists of 100 multiple choice questions and has two 30-minute essay questions. You will first have 3 hours to complete the multiple-choice section and one hour to complete the essays.

Yes. At Marian College, we support our students with placement opportunities from companies such as EY, KPMG, Deloitte, Cognizant, Tata, Wipro, Infosys, and many more top companies.

For more details: www.imanet.org

CHARTERED ACCOUNTANCY (CA)

Study CA in Kerala with Marian College, Kuttikkanam

Chartered Accountancy (CA) is the most reputed course in Finance and Auditing, conducted by The Institute of Chartered Accountants of India

(ICAI). The Institute is a statutory body set up by the Parliament, under The Chartered Accountants Act, 1949. The administration and functioning of the Institute and the profession of Chartered Accountants is regulated by the Act and is under the administrative control of the Ministry of Corporate Affairs, Government of India.

The first stage of the programme is CA Foundation which intends to bridge your knowledge gap and help you forge ahead into the advanced levels of Chartered Accountancy. Marian College Kuttikkanam is the top college in Kerala that provides best training for the CA Foundation with a track record of commendable performance and exceptional results. Marian B Com is considered as the best B Com Programme in Kerala, India and the college offers a wide variety of electives and additional training programmes including professional orientation for CA, CMA, ACCA and CMA (US). Kuttikanam, being a picturesque hill station with an ideal climate for learning, attracts students from all over the world.

CA Intermediate, the second stage of the Chartered Accountancy Programme focuses on the acquisition of working knowledge of the core functionalities of accountancy and auditing. Marian College Kuttikkanam Autonomous is one of the highly rated colleges in Kerala which is accredited by ICAI to offer oral coaching for CA. Commerce Department of Marian College Kuttikkanam imparts top quality training with experts sourced from the industry. More than conducting coaching classes, the commerce department at Marian College Kuttikkanam offers comprehensive training that will help students to secure professional qualifications and proffer internships and placement opportunities.

Average span of CA Course ranges between 4.5 to 5.5 years, depending upon the completion of 3 stages of the Academic Studies along with 3 years of Articleship Training. The various phases of the course are as follows:

Considering all these factors, Marian has earned the spot of the most reputed college in Kerala providing quality education with a motto “inform, form, transform”.

| CA Foundation | CA Intermediate | Articleship | CA Final |

| 6 months | 9 months | 3 years | After Articleship |

| Academic studies | Academic studies | Practical Training | Academic studies |

The CA course fee includes registration fees, annual fees and the cost of study materials, which does not exceed 50,000 in India. The Commerce Department of Marian College Kuttikkanam Autonomous offers training to CA students at a highly affordable rate.

| Level | Registration Fee (in INR) |

| CA Foundation | Rs. 9,000 |

| CA Intermediate | Both groups Rs. 15,000, single group Rs.11,000 |

| CA Final | Both group Rs.22,000 |

A qualified Chartered Accountant has various opportunities in the field of:

· Career in the Top Level Management, Middle Level

· Practicing Auditor / Consultant

· Government Offices

· Banking companies

· Public Sector Companies / Multinational companies

Yes.

· Even though CA course has no legal validity abroad, it is widely accepted as the top quality professional qualification all over the world

· An Indian CA is qualified for a job in Middle East, USA, Canada

| Salary | India (Per annum) | Abroad (Per annum) |

| Average | Starting 6 Lakh | 10 Lakh |

| Medium | 10 Lakh | 15 Lakh |

| High | 30 Lakh | 50 Lakh |

| CA Foundation syllabus | CA Intermediate syllabus | CA Final syllabus |

| 1. Principles and Practice of Accounting 2. Business Laws and Business Correspondence 3. Business Mathematics, Logical Reasoning, and Statistics 4. Business Economics and Business & Commercial Knowledge | GROUP-2- 1.Accounting 2.Corporate and Other Laws 3.Cost and Management Accounting 4.Taxation GROUP-2* 5.Advanced Accounting 6.Auditing & Assurance 7.Enterprise Information Systems & Strategic Management 8.Financial Management & Economics for Finance | GROUP-1* 1.Financial Reporting 2.Strategic Cost Management and Performance Evaluation 3.Strategic Financial Management 4.Advanced Auditing and Professional Ethics GROUP-2* 5.Strategic Cost Management and Performance Evaluation 6.Elective Paper 7.Direct Tax Laws and International Taxation 8.Indirect Tax Laws |

| Examination | CA Foundation | CA Intermediate | CA Final |

| Mode | Offline exam | Offline exam | Offline exam |

| Frequency (Time) | Twice a year.(May or June and November or December) | Twice a year.(May or June and November or December) | Twice a year.(May or June and November or December) |

| Pattern | CA Foundation | CA Intermediate | CA Final |

| Medium | English/Hindi | English/Hindi | English/Hindi |

| Question Type of CA Exam | Paper 1 and Paper 2 – Subjective Paper 3 and Paper4 – Objective | Objective type questions with a weightage of 30% in Papers 2, 4, 6, and 7. The remaining 70% weightage is of subjective type questions Question paper contains 6 questions. Question 1 is compulsory. Answer any 4 questions from the remaining 5 questions. | Papers 3, 4, 7, and 8 contain 30% objective-type questions. Paper 6 is an elective paper & the students need to choose any one subject out of 6 according to their preference. The remaining 70% weightage is for subjective type questions. Question paper contains 6 questions. Question 1 is compulsory. Answer any 4 questions from the remaining 5 questions. |

| Duration of CA Exam | Paper 1 and Paper 2 – 3 Hours Paper 3 and Paper4 – 2 hours | 3 Hours per paper | 3 Hours per paper |

| Marks | CA Foundation | CA Intermediate | CA Final |

| Maximum mark for CA Exam | 400 (100 marks for each paper) | Group I – 400 markGroup II – 400 mark(100 marks for each paper) | Group I – 400 markGroup II – 400 mark(100 marks for each paper) |

| Pass mark for CA Exam | 40% of each 4 papers and 50% mark in aggregate for clearing the CA Foundation exam. | 40% of each paper in each group and 50% mark (200 for one group and 400 for both groups) in aggregate for each group for clearing the CA Intermediate exam. | 40% of each paper in each group and 50% mark in aggregate for each group for clearing the CA final exam. |

| Negative Mark for CA Exam | There is a negative marking for wrong answers in objective types of questions. 1/4th of the marks are deducted for every wrong answer. | The objective-type questions follow the MCQ pattern and may be assigned one or more marks. There is no negative marking for wrong answers. | The objective-type questions follow the MCQ pattern and may be assigned with one or more marks. There is no negative marking for wrong answers. |

Option 1: Students can join after the completion of 12th standard through the foundation route. It can be done along with regular B Com offered by Colleges or distance programmes run by Universities. Students joining B Com programme at Marian College can do CA along with regular B Com or distance B Com of IGNOU. As the pass percentage is lower for professional qualifications, the risk element is mitigated to some extent with the minimum guarantee of a regular Graduation.

Option 2: Students can join after graduation through direct entry to intermediate examinations. Passing the foundation exam is not compulsory. Marian College Kuttikkanam also offers training to those who opt for this route with regular M Com or Distance M Com.

No. Strategic and disciplined approach is the only requirement to excel in CA Course.

Every year, around 1,00,000 students register for CA courses in India, after completing 12th grade. Among these, 50,000 remain inspired to become qualified chartered accountants and the remaining will follow the suit obviously in due course.

Any student who has completed plus two in any stream (including Science, Maths, and Commerce) with a minimum of 60 percentage marks is eligible to register for the CA course.

For direct entry to intermediate level, the students must obtain minimum 60% marks in graduation.

However, if the student is a Commerce graduate, the minimum mark required is 55%.

Marian College Kuttikkanam is the youngest autonomous college in Kerala owned and managed by Catholic Diocese of Kanjirappally is one of the best colleges for commerce in India.

Department of commerce is the largest department of Marian College Kuttikkanam.

The Research and PG Department of Commerce is considered the best in Kerala, India under the stewardship of eminent faculties.

Marian College Kuttikkanam the freedom to update its syllabus to meet industry standard.

Marian College Kuttikkanam is an emerging hub for Professional Studies with state of the art infrastructural facilities including hostels for boys and girls managed by Catholic Priests and Nuns.

Marian college supports the students to confidently appear for the examinations by providing mock and revision test series.

Marian College Kuttikkanam is the best college for B Com or M Com Programme as it has brought consistent good results for B Com and Professional qualifications such as CA, CMA and ACCA.

Research and PG Department of Commerce provides opportunities for internships and placements to give practical exposure to students.For more details visit: www.icai.org

COST AND MANAGEMENT ACCOUNTANCY (CMA -Ind)

Study CMA (Ind) in Kerala with Marian College, Kuttikkanam

The CMA course, popularly known as Cost and Management Accounting was formerly known as ICWAI. Institute of Cost and Management Accountants of India is the only recognised professional body in India specialising in Cost and Management Accountancy. A Cost Accountant is a person who performs the services involving verification and preparation of cost accounting and related statements. Marian College Kuttikkanam is the best college for B Com with CMA (Ind) and has consistently maintained 100 percent pass in CMA foundation examinations. Marian College is also an approved ROCC (Recognised Oral Coaching Centre) and offers training for Certified Accountant Technician examinations.

The first level of the programme is CMA Foundation / CAT (Certified Accounting Technician) which intends to bridge the knowledge gap and helps you advance into CMA Intermediate level. Marian College Kuttikkanam is the top college in Kerala that provides best training for CMA foundation with consistent 100% percentage results. The Commerce Department of Marian College is considered as the best department for commerce courses in India. The Commerce Department offers a wide variety of electives such as Finance and Taxation, Co-Operation and Business Analytics. The Commerce Department provides additional training programmes for professional orientation such as CA, CMA (Ind), ACCA and CMA (US).

CMA Intermediate, the second level of Cost and Management Accounting, helps to acquire the knowledge of cost accounting and strategic decision-making skills. The Commerce department of Marian College Kuttikkanam imparts top quality training with experts sourced from the industry. More than conducting coaching classes, the commerce department at Marian College, Kuttikkanam offers a comprehensive training that will help the students excel in their CMA (Ind) and provides opportunities for internships and placement.

The CMA program comprises of three levels. One, only becomes eligible for a higher level after she/ he has passed the previous level. Following are the three stages of the CMA course.

· Level 1 – CMA Foundation Level

· Level 2 – CMA Intermediate Level

· Level 3 – CMA Final Level

| CMA Foundation | CMA Intermediate | CMA Final | Articleship |

| 6 months | 9 months | After Intermediate | 3 years |

| Academic studies | Academic studies | Academic studies | Practical Training |

Marian College Kuttikkanam Autonomous is the youngest autonomous college in Kerala.

· Marian College Kuttikkanam Autonomous is owned and managed by Catholic Diocese of Kanjirappally.

· Marian College Kuttikkanam Autonomous is one of the best College for commerce in India.

School of Commerce and Professional Studies is the largest department of Marian College Kuttikkanam Autonomous.

· Research and PG Department of Commerce is the best commerce department in Kerala, India under the stewardship of the best pool of faculty.

· By virtue of the autonomy Marian College Kuttikkanam Autonomous holds the freedom to update its syllabus to the industry standard.

· Marian College Kuttikkanam Autonomous is an Accredited Center for providing coaching classes by ICMAI.

· Marian M Com/ B Com syllabus is mapped to the requirements of CMA Course which makes it easier for students to do CMA.

· Marian College Kuttikkanam Autonomous is an emerging hub for Professional Studies with state of the art infrastructural facilities including hostels for boys and girls managed by Catholic Priests and Nuns.

· Marian college supports the students to confidently appear for examinations by providing a series of mock and revision tests.

· Marian College Kuttikkanam Autonomous is the best college for B Com Programme as it brings consistent good results for B Com and Professional qualification such as CA, CMA and ACCA.

· Research and PG Department of Commerce provides opportunities for internships and placements.

The CMA course fees structure including registration fees, books, study material which cost around 70,000 rupees in India for the entire course, on usual terms. The level-wise registration fee for the course is mentioned below:

| Level | Registration Fee (in INR) |

| CMA Foundation | 6000 |

| CAT | 12660 |

| CMA Intermediate | 23100 |

| CMA Final | 25,000 |

A qualified Cost and Mangement Accountant is having various opportunities in the field of:

· Career in the Top Level Management, Middle Level

· Practicing Auditor / Consultant

· Government Offices

· Banking companies

· Public Sector Companies/ Multinational companies

In total, the CMA course comprises 20 papers through the three stages of the programme. The level-wise syllabus of CMA is mentioned below. Marian College Kuttikkanam Autonomous gives top quality training to CMA aspirants at an affordable cost.

| CMA Foundation Syllabus/ Subjects/ Papers | CMA Intermediate Syllabus/ Subjects/ Papers | CMA Final Syllabus/ Subjects/ Papers |

| CMA – Foundation· Paper1 Fundamentals of Business Mathematics and Statistic· Paper 2 – Fundamentals of Laws and Ethics· Paper 3 – Fundamentals of Accounting· Paper 4 – Fundamentals of Economics and Management | Intermediate-Group 1· Paper 5 – Company Accounts & Audit· Paper 6 – Indirect Taxation· Paper 7 – Cost and Management Accounting· Paper 8 – Operation Management Information System Intermediate -Group 2· Paper 9 – Cost accounting and financial management· Paper 10 – Direct Taxation· Paper 11 – Laws, Ethics and Governance· Paper 12 – Financial Accounting | Final – Group 1· Paper 13 – Financial Analysis & Business Valuation· Paper 14 – Cost and Management Audit· Paper 15 – Corporate Financial Reporting· Paper 16 – Strategic Performance Management Final – Group 2· Paper 17 – Tax Management and Practice· Paper 18 – Business Strategy & Strategic Cost Management· Paper 19 – Advanced Financial Management· Paper 20 – Corporate Laws and Compliance |

Any student who has completed plus two in any stream (including Science, Maths, and Commerce) with a minimum of 60 percentage marks is eligible to register for the CMA course. Students joining B Com programme at Marian College can do CMA along with regular B Com or distance B Com of IGNOU. As the pass percentage is lower for professional qualifications, the risk element is mitigated to some extent with the minimum guarantee of a regular Graduation

· For direct entry to intermediate level, the students must obtain minimum 60% marks in graduation. However, if the student is a Commerce graduate, the minimum mark required is 55%. Marian College Kuttikkanam also offers training to those who opt for this route with regular M Com or Distance M Com.

For more details visit: https://icmai.in

ICMAI Regional oral coaching centre (ROCC) for CAT

Study ICMAI – CAT Course in Kerala with Marian College, Kuttikkanam

Marian College is an approved ICMAI Regional oral coaching Centre for Certified Accountant Technicians Course.

Certificate in Accounting Technician (CAT) is a short term Course-Certificate in Accounting Technicians (CAT) for 12th (10+2) passed and Under Graduates. This Course has been introduced in consultation with the Ministry of Corporate Affairs, Government of India. CAT equip students to be well versed with the maintenance of accounts, preparation of Tax Returns, Filling of Returns under Companies Act, Filling of Returns under Income Tax, GST, Customs Act, Export & Import documentation etc.

Basic qualification to pursue CAT is appearing/passed 12th (10+2) class.

The course is subdivided into two phases:

A) Foundation Course (Entry Level) Part-I

Paper 1: Fundamentals of Financial Accounting.

Paper 2: Applied Business and Industrial Laws

Paper 3: Financial Accounting-2

Paper 4: Statutory Compliance

B) Competency Level – Part-II

I. Computer Fundamentals by Microsoft and Computerized Accounting- Tally ERP 9.0-– 35 hours -SAP End User Program -25 hours , Cambridge -Generic Skills for Employability– 20 hours , E-filing by experts from Industry– 20 hours ,Introduction to Costing Principles & Preparation of Cost Statements- 40 hours.

II. Five-day Orientation Program/ ASK Programme, ASK = Attitude Skill Knowledge

III. Internship:- The Internship will be for 45 days. The Internship can be taken from organizations prescribed under the Internship scheme of CAT Course.

Multiple choice question to be answered online.

Last Date for Admission:-

1. For June Term Examination – 31st January

2. For December Term Examination – 31st July

CAT Pass certificate is issued on the successful completion of the examination, Assessment Test, 3 Months Internship, Computer training and 5 days orientation programme.

The CPA exam is conducted by the American Institute of Certified Public Accountants (AICPA). It is a globally recognized designation for which aspirants need to take the Uniform CPA Examination. This is equivalent to Chartered Accountant (CA) designation in India. The CPA certification is the highest standard of competence in the field of accountancy globally and is a highly sought-after and versatile credential for accountants.

To become a licensed Certified public accountant (CPA), one must meet education, examination and experience requirements—including holding a bachelor’s degree in business administration, finance, or accounting, and obtaining 150 credits. Other requirements for the CPA designation include, passing the Uniform CPA Exam and having one or more years (approximately 2000 hours) of public accounting experience, verified by a licensed CPA.

The CPA exam is a 16-hour, four-section test that all 55 jurisdictions in the US require you to pass in order to qualify for a CPA license. The CPA Exam is owned by the AICPA, and administered in Prometric test centers by NASBA and the AICPA on behalf of the state boards of accountancy. CPAs generally hold various positions in public and corporate accounting, as well as executive positions, such as the controller or chief financial officer (CFO).

Marian College imparts quality training to the CPA aspirants from experienced tutors with industrial exposure. This comprehensive professional training offered by the Commerce Department of Marian College Kuttikkanam Autonomous aims at guiding the students to be future-ready and helps them in their career progression

- The students should have a minimum of 120 credits to enrol in the CPA program.

- The students should obtain 150 credits to get the CPA license.

- The students should have 1-2years of experience working under the direction of a licensed CPA to obtain the CPA

. PAPER 1- Financial Accounting and Reporting (FAR)

· PAPER 2- Auditing and Attestation (AUD)

· PAPER 3- Regulation (REG)

· PAPER 4- Business Environment and concepts

The students need to complete their 4 paper assessments of the CPA course within a span of 18 months from the date of NTS (Notice to schedule) with a minimum score of 75.

The four-hour-long exam sections includes different item types, namely, Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG) are the four areas of the CPA exam.

multi-choice questions (MCQs- 1 Question, 4 Answer Choices),

task-based simulations (TBS- Multiple sub-questions, with more than 4 answer choices), and

written communication tasks (WCT- Essay Type Question, 500 words to be typed).

Registration for CPA is open all throughout the year, can enroll anytime for the exam.

The CPA Exam is accessible within India at eight Prometric exam centers

- Ahmedabad

- Bangalore

- Calcutta

- Chennai

- Hyderabad

- Mumbai

- New Delhi

- Trivandrum

Marian College kuttikkanam Autonomous motivates students to apply topics learned in class and prepare for career realities. Marian is dedicated to assisting you at every stage of the process. Marian offers the most extensive study and coaching system available, along with strong practice tools and professional teachers, for rigorous preparation. We provide hands-on and experience learning, as well as soft skills training and job placement support.

Companies hiring CPA (US) professionals

There is a wide assortment of opportunities for students, who qualify for the US CPA course examination. At present, United State organizations having Indian offices are also hiring the public certified accountants. Few of the prominent companies that are hiring Certified Public Professionals include Genpact, Philips, Deloitte, Accenture, Cognizant, etc. The Certified Public Accountants are also found to work for BIG4. Few popular clients of BIG4 include PWC, KPMG, Deloitte, Ernst, and Young. The services provided by these firms are in higher demand and thus they have gained high popularity in hiring the CPAs in India.

Job Opportunities for CPA (US)

CPAs can act as a specialist in the areas:

· Financial Analyst

· Management Accountant

· Risk and Compliance Analyst

· Tax Accountant

· Management Consultant

· Information Technology Auditor

· Finance Director

· Investment Banking

· Equity research

- REGISTRATION FEES:

Application fees varies from USD 170 – 225 depending on the states

- EXAMINATION FEES:

Exam fee is Approx. USD 598 for each paper (Total 4 papers) depending on the states.

- International exam testing fees is also levied

For fresher’s average salary USD 66,000 per annum. Average salary for a US CPA is USD 119,000.

The scores of each CPA exam of CPA is scaled from 0-99. To pass the exam, a minimum of 75 points are required.

Pass rate of US CPA is nearly 51%.

CPA is valid in the USA, India and around the world. CA (Chartered Accountant) and CPA (Certified Public Accountant) are considered to be the highest credential in the field of accounting. For fresher’s average salary Rs. 6 lakhs per annum. Average salary Rs. 9.25 lakhs per annum. US CPA salary in big 4 in the range of Rs.12.5 – 20.4 lakhs per annum.

Diploma Programmes

| Advanced Diploma in Business Accounting and Finance |

| Advanced diploma in Management Accounting and Analytics |

| Advanced diploma in Finance and Auditing |

| Advanced Diploma in Technological Competencies for Business |

Besides, the commerce department offers Certification programmes on IFRS, Financial Modelling, Block Chain, Supply Chain Management etc are provided in association with GT. For the holistic development of students of BCom program, we also give training for life skill competencies such as Gardening, Cooking,Home Interiors, Health & physical Fitness classes to equip the students to properly manage their personal and professional life.

The admission to Value added Programmes are not restricted to B Com students. The students of other departments in the college and external students / professionals / employees from corporate sector can also join these programme as these trainings are scheduled outside regular class timings and mostly conducted online.

Eligibility for Admission to Professional Orientation and Diploma Programmes

Additional Training Programme for Professional Orientation shall be open only to candidates who have passed the Plus Two or equivalent examination recognized by the University. The selection will be based on the merit list prepared based on the plus 2 marks and MPAT Test.

Admission for Additional Training Programme – Professional Orientation

The Additional Training Programme – Professional Orientation are designed in such a way to equip the students to confidently pursue professional accounting qualifications such as

ACCA(UK)/CA (IND)/CMA(IND)/CMA(US). Additional Trainings are given by sourcing professionally qualified visiting faculty from outside to provide the professional level orientation and expertise to such students who wish to develop a professional level knowledge and skill.

However, entry to Additional Training Programmes for Professional Orientation will be based on the merit list prepared based on the plus 2 marks, MPAT Screening Test and Interview. The screening test and interview is meant to assess whether the students has the right professional aptitude and the required caliber to clear the professional level examinations.

| Additional Training Programme – Professional Orientation |

| Association of Chartered Certified Accountants (ACCA, UK) |

| Certified Management Accountants(US) CMA (US) |

| Cost and Management Accountancy (CMA – India) |

| Chartered Accountancy – CA |

Value Added Courses

The unique specialty of the B Com programme at Marian College Kuttikkanam is that it offers a host value of added courses in the form of non credit courses, diploma/ certificates. The continuous value enrichment in the curriculum and learning process helped Marian to earn the fame of the most reputed commerce college and commerce department in Kerala providing top quality commerce education with a motto “ inform, form, transform”

Professional Studies

Eligibility for Admission to Professional Orientation and Diploma Programmes

Additional Training Programme for Professional Orientation shall be open only to candidates who have passed the Plus Two or equivalent examination recognized by the University. The selection will be based on the merit list prepared based on the plus 2 marks and MPAT Test.

About

The department offers the following two options to students who wish to pursue any professional accounting qualifications mentioned above,

1. B Com @ Marian (syllabus tailored as per Professional Accounting Qualifications)

2. Advanced Diploma Programmes (syllabus tailored as per Professional Accounting Qualifications)

The first route is meant for B Com students who wish to undertake professional accounting qualifications along with regular B Com programmes. They are at a huge advantage as the existing syllabus is tailored as per the syllabus of leading professional accounting qualifications in India and abroad. The additional training programmes imparted mould such students to the level of expertise expected from such professionals.

The second route is apt for students who wish to take up and focus primarily on any Professional qualification immediately after their plus two. Such students can join any of the specifically designed Value Added Diploma Programmes and get them trained in their preferred choice of professional expertise. The syllabus of these diploma programmes are mapped to the syllabus of the respective professional qualifications. Consultancy and Extension wing the department offers additional training through our industry partners/professional bodies to equip students for such professional qualification. The certification programmes such as:

1. Advanced Diploma in Finance and Taxation

2. Advanced Diploma in Financial and Management Accounting

3. Advanced Diploma in International Financial Reporting and Auditing

4. Advanced Diploma in Strategic Financial Management and Analytics

5. Advanced Diploma in Strategic and Risk Management

The wing also gives necessary guidance to such students to pursue graduation/post-graduation

degrees along with professional studies, under Distance/Private Mode.

The Association of Chartered Certified Accountants (ACCA) institute, formed in 1904 is the global professional accounting body offering the “Chartered Certified Accountant” qualification. ACCA is a fast growing international accountancy organisation with 2,00,000 members and 4,86,000 students in 180 countries. As a globally recognized education and updated/Industry relevant content, ACCA qualification is a great way to build a career in

Accounts and finance. Students can pursue this along with their graduation. Its flexible examination scheme makes this qualification more attractive.Students who pursue B Com at Marian will get 6 paper exemptions from ACCA Examination along with other financial benefits.

Students pursuing ACCA can avail:

- Diploma/Advanced Diploma in Accounting and Business and go on to earn an ACCA Member status

- BSc. (Hons) degree in Applied Accounting awarded by Oxford Brookes University by completing just One Professional Ethics Module and One Project.

- MSc in Professional Accountancy from the University of London in addition to your ACCA Qualification by completing just one module and one project.

CMA – US

Certified Management Accountant (CMA -USA) is the highest level of certification in management accounting that acts as a global passport for accountants and finance professionals. Institute of Management Accountants (IMA), USA has 1,25,000+ members spread across 140 + countries and 300 chapters.CMA USA course training is a hands-on experiential program that helps you clear the exams, provides soft skills training and Career services. Depending on the candidate’s dedication and focus, it takes a minimum of 6 months to complete the CMA course. IMA provides a duration of maximum 3 years, from the date of registration, to complete the CMA Course. Candidates can appear for the part 1 and 2 exams in: January/February, May/June and September/October.

Eligibility:

- 12th Pass or above

- A Bachelor’s Degree from an accredited college/university

- 6 to 9 Months

CIMA – UK

The Chartered Institute of Management Accountants (CIMA) is a UK based professional body offering training and qualification in management accountancy. Together with the American Institute of Certified Public Accountants (AICPA), we established the Chartered Global Management Accountant (CGMA) designation in 2012 to provide members with a new level of resources and recognition. Examinations are MCQ tests and one Case Study exams are available four times a year.Full completion of the CIMA qualification, including the practical experience requirement, is broadly equivalent to a Master’s degree and has post-graduate status in the UK.

Eligibility:

- 12th Pass or above

- Duration: Two years for four levels

CA – Ind

Chartered Accountant is a designation that is given to a professional of accounting who has received certification from The Institute of Chartered Accountants of India (a statutory body) by the successful completion of the chartered Accountancy Course. He/ she possesses the necessary qualifications to take care of the matters related to accounting and taxation of a business. These matters include filing tax returns, maintaining records of investments, audit financial statements and business practices, preparing and reviewing financial documents and reports. A Chartered Accountant is also qualified and capable of offering advisory services to clients that comprise companies and individuals.

Eligibility

- 10th class or any course equivalent to that can apply for the CA Foundation Course first.

- After the Plus Two exam, a student has to then qualify for the CA Foundation exam.

- After Graduation in any discipline other than Fine Arts

CMA – Ind

Cost Accounting Management is a certificate program designed to train students for working in different industries and corporate functions. In India, the credentials of the CMA course are issued by the Institute of Cost Accountants of India (ICAI). The program mainly focuses on valuation issues, financial statement analysis, working capital policies, external financial reporting, etc.

Eligibility

- After Plus Two exam, register for Foundation Course of the Institute of Cost Accountants of India.

- Graduation in any discipline other than Fine Arts.

Besides, the commerce department offers Certification programmes on IFRS, Financial Modelling, Block Chain, Supply Chain Management etc are provided in association with GT. For the holistic development of students of BCom program, we also give training for life skill competencies such as Gardening, Cooking,Home Interiors, Health & physical Fitness classes to equip the students to properly manage their personal and professional life.

ACADEMICS

- Department of Economics

- Department of Communication and Media Studies

- Department of Hospitality and Tourism Management

- Department of Languages

- Department of Mathematics

- Department of Physics

- PG Department of Computer Applications

- School of Social Work

- UG Department of Business Administration

- UG Department of Computer Applications

- School of Commerce and Professional Studies

- Marian Institute of Management[MBA]